Knowledge evaluation knowledgeable BigBear.ai (NYSE:BBAI) has soared in 2024. On New Yr’s Eve morning, the inventory was up 128% in 52 weeks. Inquiring minds (and growth-hungry traders) wish to know if the beneficial properties can proceed into 2025 and past.

So let’s check out BigBear.ai and its development prospects. Is that this an important synthetic intelligence (AI) inventory to purchase in early 2025?

BigBear.ai isn’t a legendary identify, regardless that its essential enterprise has been round because the Nineteen Eighties.

The present type of this firm got here into existence in 2020, when a special purpose acquisition company (SPAC) named Lake Acquisition has acquired a number of AI-based enterprise intelligence corporations. This preliminary splurge included the makers of well-known software program such because the ProModel course of simulation package deal, in addition to the technical consulting companies of Open Options Group. A few of these operations had been based within the late Nineteen Eighties and early Nineteen Nineties.

The ensuing group gives AI-driven knowledge analytics companies for healthcare, authorities and heavy building corporations. The U.S. Military, Navy and Air Drive are three of the corporate’s largest clients. Its programs assist individuals handle and arrange tools and different assets on a big scale, usually below tight deadlines.

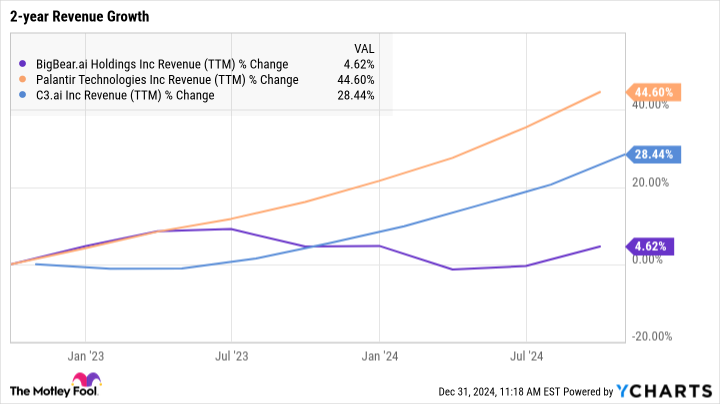

If my description of BigBear.ai seems to be quite a bit like C3.ai (NYSE:IA) Or Palantir Applied sciences (NASDAQ:PLTR), you are on the right track. These corporations usually bid on the identical contracts. Computerized assist for the protection sector is a big and thriving market, and BigBear.ai is a diversified firm with vital pursuits in different rising sectors.

The direct comparability with C3.ai and Palantir raises essential questions on BigBear.ai. The corporate is catering to some main markets, however how large and profitable has it been to date?

Here is how BigBear.ai at present compares to its essential opponents:

|

Metric |

BigBear.ai |

Palantir |

C3.ai |

|---|---|---|---|

|

Market capitalization |

$1.14 billion |

$174.5 billion |

$4.56 billion |

|

Inventory market efficiency over one yr |

114% |

347% |

23% |

|

Income (TTM) |

$155.0 million |

$2.65 billion |

$346.5 million |

|

Adjusted web revenue (loss) |

($57.5 million) |

$476.6 million |

($274.4 million) |

Knowledge supply: collected from Finviz and YCharts on December 31, 2024. TTM = final 12 months.

BigBear.ai is the smallest identify on this group. The inventory has been climbing just lately, however hasn’t been in a position to preserve tempo with Palantir’s large beneficial properties.

It is essential to notice that BigBear.ai’s current value will increase haven’t been pushed by sturdy enterprise outcomes or new contract bulletins. Certainly, the inventory fell almost 11% within the days following its newest earnings report, which met Wall Avenue expectations however missed consensus income targets.

#purchase #synthetic #intelligence #inventory , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america