It has been a topsy-turvy yr for Tremendous microcomputer (NASDAQ:SMCI). As soon as seen as the subsequent large factor in synthetic intelligence (AI), it has collapsed in current months amid issues concerning the reliability of its numbers and accounting controls.

Nevertheless, after hitting a low of $17.25 on November 15 amid fears that it is perhaps delisted, Nasdaq inventory market, the inventory has rebounded strongly and lately traded round $30. With a brand new auditor in place and a plan to file its monetary statements (that are overdue) by February, buyers appear way more snug with the inventory lately.

However when you is perhaps tempted to purchase into the rally, there’s nonetheless important danger right here, and a number of the reason why the inventory might endure a major pullback in 2025.

Relating to AI Actionsthe secret is progress. Tremendous Micro has seen important demand for its servers and storage merchandise as corporations race to develop AI fashions.

As a result of the corporate remains to be transitioning to a brand new auditor, it hasn’t launched full quarterly numbers since August. In November, nonetheless, the corporate launched its preliminary outcomes for the primary quarter of fiscal 2025 (ended September 30). What was somewhat regarding is that Tremendous Micro expects its internet gross sales to be between $5.9 billion and $6 billion. That is significantly decrease than its earlier estimate, which known as for gross sales of between $6 billion and $7 billion. These aren’t last numbers, nevertheless it seems to be a major miss and it raises the query of whether or not the corporate is experiencing a slowdown in demand.

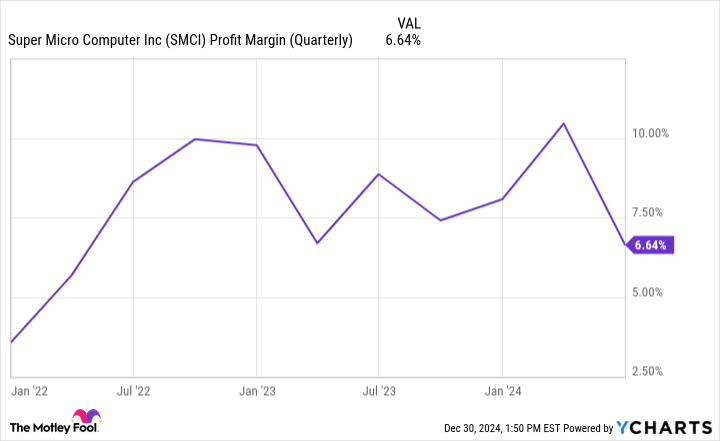

Even when Tremendous Micro releases its financials in a well timed method, that does not imply the outcomes will essentially be nice or what buyers will wish to see. Whereas $6 billion in gross sales would nonetheless signify an unbelievable 183% year-over-year enhance, the issue is that the Tremendous Micro gross margins nonetheless stay extremely low.

To allay issues about accounting controls and procedures, it appears inevitable that Tremendous Micro should rent extra workers and spend cash implementing extra protocols to assist it preserve the accuracy and integrity of its monetary statements.

These extra charges might imply that Tremendous Micro’s revenue margins will turn into even narrower. The narrower these margins are, the much less revenue the corporate will get from any extra greenback of gross sales. In its preliminary figures for the primary quarter, Tremendous Micro’s gross margin was simply 13.3%. Whereas that is technically an enchancment over the 11.2% reported 1 / 4 earlier, it is nonetheless woefully low – and the gross margin comes Earlier than overheads and different oblique bills. The fact of the corporate revenue the margin might be even narrower.

#Tremendous #microcomputer #inventory #rallied #heres #begin #gradual , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america