(Bloomberg) — Over the previous a number of years, the U.S. financial system has constantly defied expectations of a slowdown, and 2024 was no exception.

Most learn on Bloomberg

Regardless of uncertainty over a presidential election, excessive rates of interest and a slowing job market, financial development has remained robust this yr. The US is predicted to be the perfect performing nation among the many Group of Seven international locations, in accordance with Worldwide Financial Fund projections.

But the financial system was removed from good. Inflation proved sluggish to say no, main the Federal Reserve to undertake a better, longer rate of interest method. The true property and manufacturing sectors continued to undergo below the load of excessive borrowing prices, and shoppers in debt with bank cards, mortgages and different loans noticed delinquency charges rise.

This is a better have a look at how the U.S. financial system is performing this yr:

The reply to why the financial system outperformed expectations in 2024 lies with the American client. At the same time as hiring slowed, wage development continued to outpace inflation and family wealth reached new data, supporting continued enlargement of their spending.

Bloomberg Economics forecasters estimate that family spending will enhance 2.8% in 2024, sooner than in 2023 and nearly twice their projection in the beginning of the yr.

Though shoppers are nonetheless resilient, among the key drivers of this outstanding resilience have misplaced steam this yr. People have largely exhausted their pandemic financial savings and have usually put aside a smaller share of their revenue every month.

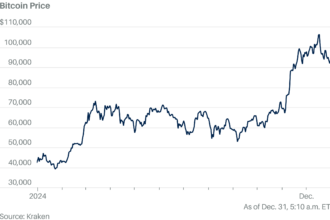

Client spending can also be more and more pushed by excessive earners who profit from a so-called wealth impact from rising home costs and the inventory market. This comes as many low-income shoppers depend on bank cards and different loans to assist their spending, with some exhibiting indicators of monetary hardship like larger delinquency charges.

The principle assist for client spending additionally started to ship out warning indicators in 2024. Hiring slowed all year long and the unemployment charge rose barely, triggering a preferred recession indicator. As well as, the variety of job alternatives has decreased and the unemployed are discovering it more and more troublesome to search out new employment.

Fed officers started chopping charges in September, fearing that the labor market was nearing a harmful tipping level, though they turned extra optimistic within the ultimate months of the yr, the unemployment charge having stabilized round ranges that stay low by historic requirements. Wage development, for its half, stays secure at round 4%, which ought to proceed to assist family funds.

#American #financial system #surprises #drama #Fed #elections , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america