It is the vacation season! Now we have two consecutive brief buying and selling weeks on the way in which, with Christmas and New Years approaching. I have a look at historic information on how shares have a tendency to maneuver in these weeks. Subsequent, I will have a look at the precise Santa Gathering because it has been formally outlined. Lastly, I will checklist some particular person shares to look at throughout essentially the most great time of the yr.

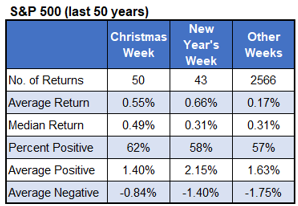

The desk under summarizes the weekly returns of the S&P 500 Index (SPX) over the previous 50 years. Some years, merchants haven’t got a break day for New Years, which is why there are lower than 50 weeks for New Years. Consumers appear to be sticking round for the vacations, as these weeks have been bullish for actions. The SPX averages a 0.55% return over the Christmas week, with 62% of returns constructive. New 12 months’s Eve did even higher, with a median return of 0.66%. These vacation weeks simply beat the SPX’s typical weekly return of 0.17%.

The overall outperformance of shares on the finish of the yr is commonly casually known as the Santa Claus rally. Nonetheless, in response to Investopedia, the time period was first utilized in 1972 by Yale Hirsch, the founding father of the Inventory Dealer’s Almanac. It outlined Santa’s Rally as the primary two buying and selling days of the brand new yr in addition to the final 5 buying and selling days of the earlier yr. So let’s check out how these seven particular buying and selling days have carried out over the previous 50 years.

This has certainly been a bullish interval. The S&P 500 averaged a return of greater than 1% with constructive returns 74% of the time throughout these seven buying and selling days. The index’s typical 7-day return was 0.26%, with 58% of returns constructive.

The next desk lists the S&P 500 shares that carried out greatest through the Santa Rally over the previous 10 years (sorted by % constructive then common return). Newmont (NEM) tops the checklist with a median return of over 4% with 90% of returns constructive. I see a couple of names from actual property and healthcare corporations, however no single sector dominates the checklist.

Lastly, some shares have underperformed throughout this era. The next desk reveals the worst performing S&P 500 shares through the Santa Claus Rally interval. CME Group (CME) tops this checklist, ending constructive only one out of 10 instances over these seven buying and selling days. Curiously, some large-cap shares seem on this checklist, together with Microsoft (MSFT), Nvidia (NVDA), and Apple (AAPL). An honest variety of data expertise corporations carried out poorly, because the desk under reveals.

#Worst #Vacation #Shares #Choices #Merchants , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america