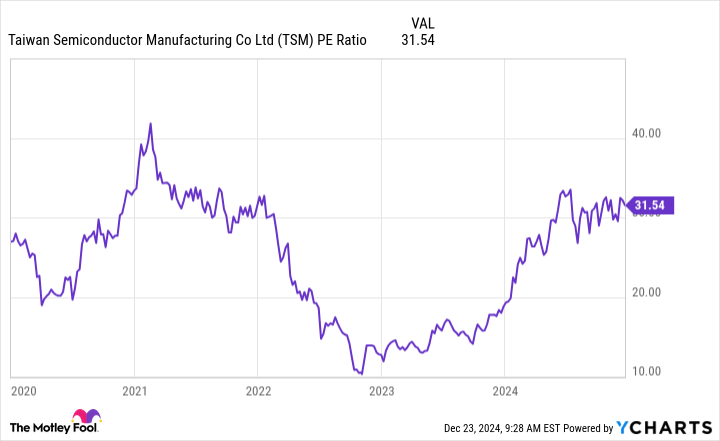

Though an organization’s previous efficiency is not any assure of its future outcomes, historical past is among the few affordable components we are able to use to information our forecasts. Notably for cyclical corporations, this generally is a superb indicator of what is to come back. I see a scenario that appears extraordinarily promising for Semiconductor manufacturing in Taiwan (NYSE:TSM) as her setup is just like the situation she noticed in 2020.

The final time Taiwan Semi had the same setup to the present one, the inventory has doubled within the 12 months since. So may he repeat this efficiency in 2025?

Taiwan Semiconductor is the world’s largest third-party chip producer. It outsources its chip manufacturing capabilities to shoppers like Nvidia (NASDAQ:NVDA) And Apple (NASDAQ:AAPL)which signifies that a big portion of the world’s strongest units comprise chips from TSMC’s foundries.

Taiwan Semi additionally has the potential to provide chips utilizing probably the most superior course of at the moment accessible: the 3nm course of node. Node measurement referred to the smallest distance in nanometers between particular options on a chip; though that is now not the case, every successive discount in node measurement represents a major enchancment within the density and processing energy of the chips produced.

The 3nm node packs plenty of processing energy, however Taiwan Semi is already engaged on a 2nm course of and plans to start out utilizing it to make chips for its clients in late 2025. It is all a reminder of what the corporate was like in its early days. entrance. 2020.

On the time, Taiwan Semiconductor had simply launched its 5nm chips, which have been an enchancment over its earlier best-of-breed 7nm chips. Moreover, an enormous wave of chip demand was about to hit TSMC (even when it did not realize it) when COVID-19 shut down the world, inflicting many individuals to improve their computer systems and different units digital so as to have the ability to work extra effectively. and studying remotely, and utilizing video chat companies to remain in contact with these exterior of their properties.

As we enter 2025, there’s large demand for AI chips, and TSMC will launch 2nm chips later this 12 months. Within the third quarter of 2023, administration projected that AI chip gross sales would develop at a compound annual fee of fifty% over the subsequent 5 years, and predicted that by the top of that interval they’d signify a proportion of its income. enterprise within the weak youngsters.

Nevertheless, this progress has up to now been even quicker than administration had anticipated. AI revenues are anticipated to triple in 2024 and signify a proportion of revenues of round 15%. Administration has indicated that there aren’t any indicators of this progress slowing heading into 2025, so the forms of secular tendencies that prevailed in 2020 are anticipated to manifest in 2025 as effectively.

#time #Taiwan #Semiconductor #inventory #doubled #12 months , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america