(Bloomberg) — The Federal Reserve shook U.S. markets on Wednesday, pushing shares decrease and sending Treasury yields hovering, after forecasting fewer rate of interest cuts subsequent yr. It was the worst loss for the S&P 500 on the day of a charge determination since 2001.

Most learn on Bloomberg

The S&P 500 fell beneath the 6,000 stage, struggling its worst session since August. The tech-heavy Nasdaq 100 index fell 3.6%, its highest stage in 5 months. Micron Know-how Inc. fell in post-market buying and selling after reporting earnings.

Subscribe to the Bloomberg Dawn podcast on Apple, Spotify or wherever you hear.

The 2-year U.S. Treasury yield, delicate to financial coverage, jumped 10 foundation factors to 4.35% and the 10-year charge rose to a stage final seen in Could. Bloomberg’s greenback indicator reached its highest stage since November 2022.

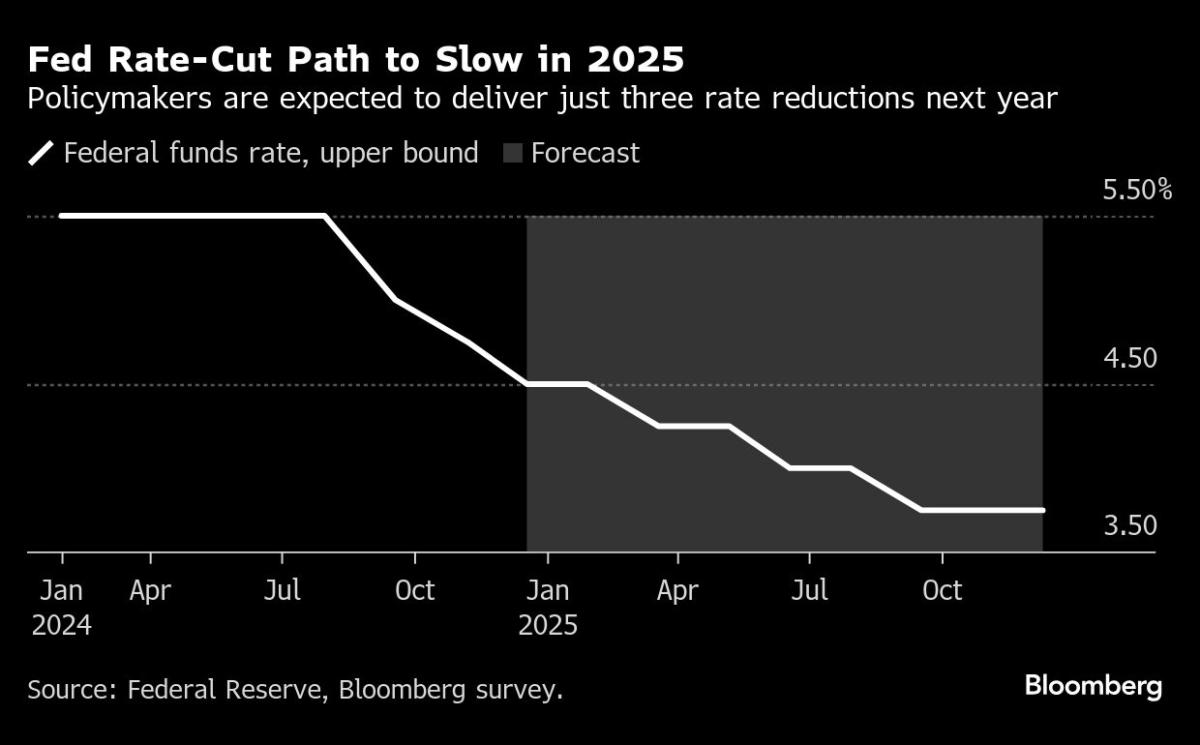

As Jerome Powell introduced a extensively anticipated quarter-point charge minimize following a gathering of the Federal Open Market Committee, the central financial institution signaled rising mistrust of inflation , together with a discount within the extent to which members count on easing to go in 2025. Powell reiterated that the central financial institution can be extra cautious because it considers additional changes to the coverage charge and declared that the Fed was decided to realize its 2% goal.

“We have to see progress on inflation,” Powell stated. “That is the way in which we take a look at it. It is one thing new. We moved rapidly to get right here, however going ahead, we transfer extra slowly.

The pace of Wednesday’s decline is commensurate with the pace with which the Fed returned to a posture of wariness within the face of inflation. Earlier than the final session, the S&P 500 index had jumped greater than 10% because the July 31 FOMC charge determination, wherein the central financial institution deserted its unilateral evaluation of dangers and stated that sustaining the growth of the labor market had change into a serious precedence.

Throughout Wednesday’s press briefing, the president additionally stated that some policymakers have begun to issue into their forecasts the potential impression of upper tariffs that President-elect Donald Trump could implement. However he added that the impression of such coverage proposals was at this stage very unsure.

Max Gokhman, senior vice chairman of Franklin Templeton Funding Options, referred to as Powell a “hawk in dove’s clothes.”

“At the same time as he downplayed the latest slowdown in disinflation whereas boasting about sturdy financial momentum, he nonetheless prompt that the tariffs wouldn’t be thought-about transitory and that the forecast of two reductions for 2025 was crucial as a result of the coverage needed to stay restrictive,” he stated. stated.

The final time the S&P 500 skilled losses of this magnitude on the day of the Fed’s determination was September 17, 2001, when the index fell almost 5%. It fell 12% on March 16, 2020, a day after the Federal Reserve’s emergency pandemic weekend assembly.

#experiences #Feds #worst #day #Yields #rise #markets #falling , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america