THE S&P500 (INDEXSNP: ^GSPC) is broadly thought of the very best indicator of the complete U.S. inventory market. Certainly, its 500 member firms cowl roughly 80% of nationwide shares by market worth and the index contains worth shares and development shares from the 11 inventory sectors.

The S&P 500 is up 24% yr thus far as of December 30, propelled larger by sturdy financial development and enthusiasm for synthetic intelligence (AI). Which means the index has returned greater than 20% in two consecutive calendar years, one thing it final did in 1998. Whereas this momentum bodes properly for 2025, excessive valuations may create turbulence within the new yr.

This is what buyers must know.

THE S&P500 has solely elevated by greater than 20% within the three consecutive years since its inception in 1957. All three incidents have been clustered in shut proximity to the Internet bubble.

The chart under exhibits the efficiency of the S&P 500 within the 12 months following the two-year durations wherein the index gained greater than 20% in each years.

|

Two-year durations with S&P 500 returns above 20% in each years |

S&P 500 efficiency (subsequent 12 months) |

|---|---|

|

1995 and 1996 |

31% |

|

1996 and 1997 |

27% |

|

1997 and 1998 |

20% |

|

Common |

26% |

Information supply: YCharts. Desk by creator.

As famous above, the S&P 500 returned a median of 26% within the 12-month interval following consecutive calendar years with positive factors larger than 20%. This confirms the Wall Avenue aphorism that inventory market momentum begets extra momentum.

The chart implies that the S&P 500 may rise 26% in 2025. However what the chart would not present is the inventory market crash that adopted the dot-com bubble. After peaking in March 2000, the S&P 500 index plunged almost 50 p.c, as buyers realized that many Web start-ups have been buying and selling at absurd valuations.

To be clear, I do not imagine the factitious intelligence growth is a repeat of the dotcom bubble. For one factor, the shares of the “Magnificent Seven” have less expensive valuations than these of the largest tech shares of the late Nineteen Nineties. However cheaper is not low cost. The inventory market may be very costly right this moment, which may result in issues in 2025.

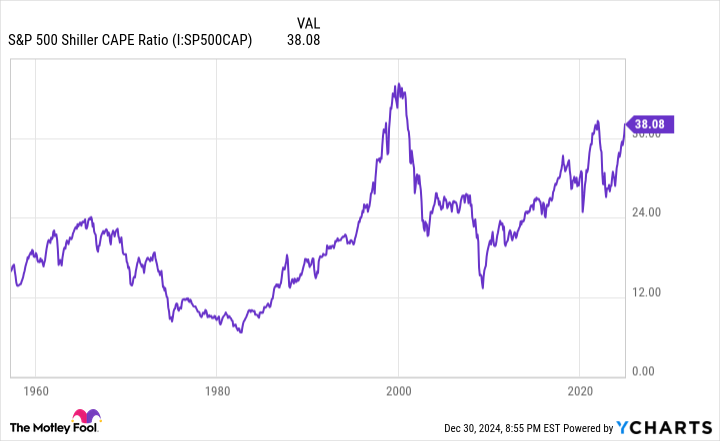

The cyclically adjusted price-to-earnings (CAPE) ratio is usually used to guage the S&P 500. Traders could know this metric by one other identify, the Shiller P/E, as a result of it was developed by the award-winning economist Nobel Prize winner and former Yale professor. Robert Shiller.

#inventory #market #Historical past #occur , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america