You’ll suppose that about half of the shares within the S&P500 do higher than common in a given 12 months. One would anticipate a balanced distribution between increased and decrease market gamers.

The fact is that the precise proportion goes up and down in actual time. And customarily talking, solely about 20% of the S&P 500 constituents outperform the market common. Because of this discovering a winner is so essential.

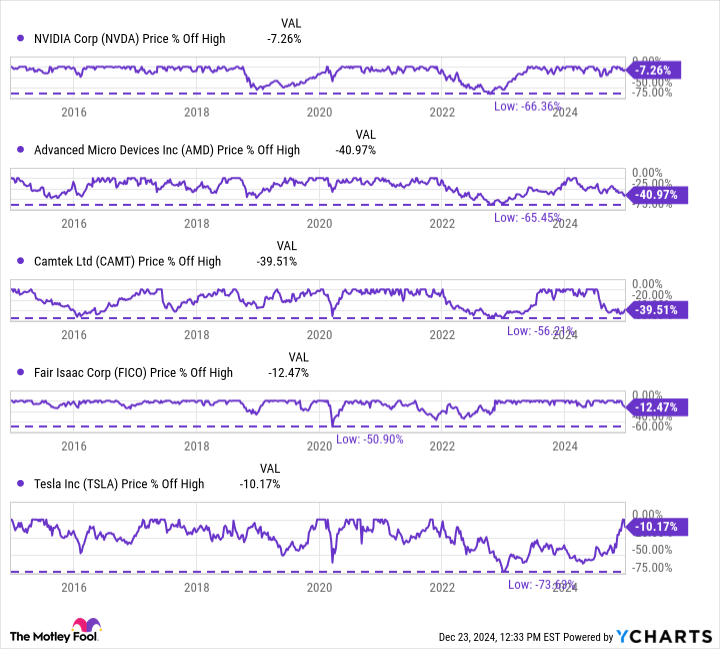

In accordance with MacroTrends, the 5 finest shares of the final decade are Nvidia (NASDAQ:NVDA), AMD (NASDAQ:AMD), Camtek (NASDAQ:CAMT), The righteous Isaac (NYSE:FICO)And Tesla (NASDAQ:TSLA). These shares have compound annual growth rates between 40% and 75%. On the low finish, a $10,000 funding in Tesla 10 years in the past is value $290,000 at this time. On the excessive finish, a $10,000 funding in Nvidia again then is value almost $2.7 million at this time.

A key factor of The Motley Fool Investing Philosophy is to “let the winners in your portfolio maintain successful.” There are comparatively few winners, and when you have a winner in your portfolio and also you promote it prematurely, you might have about an 80% likelihood of changing it with a loser.

Sounds easy, proper? Simply purchase good shares and maintain on to the massive winners. However in actuality, Nvidia, AMD, Camtek, Truthful Isaac, and Tesla all share one shocking factor that has made it extraordinarily tough to personal them over the previous decade.

Over the previous 10 years, the worth of those 5 shares have all fallen by 50% or extra at the very least as soon as. Tesla is down greater than 70% from its 10-year excessive. And even the mighty Nvidia fell 66% as lately as 2022.

Nvidia has truly fallen 50% or extra twice within the final decade. Tesla has performed it thrice. The identical goes for AMD, if we around the numbers barely, and it is at the moment down 40% from the highs reached earlier this 12 months.

NVDA knowledge by Y Charts.

When a inventory falls this far, there’ll all the time be damaging headlines fueling long-term fears. And these bear circumstances will scare traders into considering that the time to promote has come.

On the one hand, it is simple to sympathize with somebody who has bought. Think about having a place value tons of of 1000’s of {dollars} that drops 50%. It will make you sick to your abdomen to see a lot revenue disappear. However however, promoting any of those 5 shares after a 50% decline was in the end a nasty transfer, inflicting sellers to overlook out on huge positive aspects.

Charlie Munger, a number one funding professional, stated: “In case you are not ready to react with equanimity to a 50% drop in market costs two or thrice a century, you aren’t match to be an extraordinary shareholder and also you deserve the mediocre consequence you get. “I will be in comparison with individuals who have that temperament, who may be extra philosophical about these market fluctuations.”

#Stunning #Shares #Decade #Widespread , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america