Warren Buffett’s enterprise Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) has been accumulating cash all yr. On the finish of the third quarter of 2024, Berkshire had greater than $320 billion in money and short-term Treasury bonds.

Many see this as a deafening warning buyers that the market, which has reached 57 all-time highs and exceeded 6,000 a number of instances this yr, is anticipated to see a pullback sooner somewhat than later. Nevertheless, lately Buffett and Berkshire acquired $563 million price of shares in three corporations, disclosures Berkshire needed to make as a result of it already owns greater than 10% of every firm.

Are Buffett and Berkshire beginning to see worth within the inventory market?

A number of days in the past, Berkshire filed Type 4 paperwork disclosing new purchases in Western oil (NYSE:OXY), SiriusXM (NASDAQ:SERI)And VeriSign (NASDAQ:VRSN). The corporate bought roughly $405 million price of Occidental Petroleum, $113 million price of Sirius XM and roughly $45 million price of VeriSign. His new purchases convey his place on every inventory to:

-

Western oil: 264.2 million shares, 28.2% of the corporate and 4.2% of Berkshire’s portfolio.

-

SiriusXM: 117.5 million shares, 34.6% of the corporate and 0.9% of Berkshire’s portfolio.

-

VeriSign: 13 million shares, 13.6% of the corporate and 0.9% of Berkshire’s portfolio.

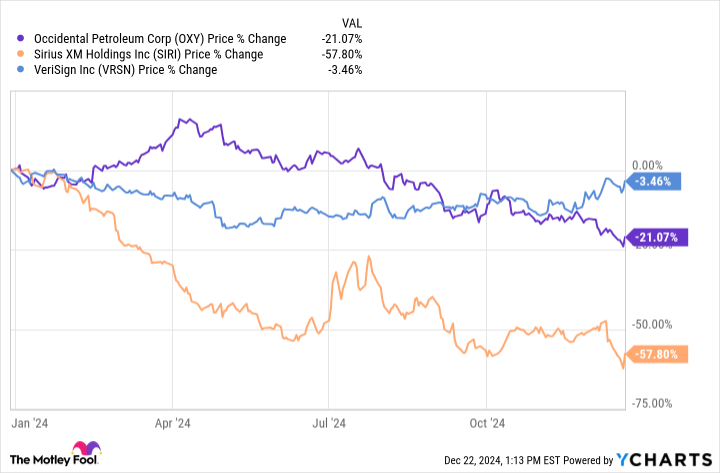

Apparently, none of those shares have carried out effectively this yr, regardless of the general market rising practically 26%.

Nevertheless, all of those shares are traditional worth shares that Buffett and Berkshire have tended to carry – and really efficiently. Occidental, a nationwide oil firm, has struggled as a consequence of falling oil costs and the grim outlook for oil in 2025. It’s evident, nonetheless, that Buffett and Berkshire have completely different emotions in regards to the route of the oil, no less than in the long run, and see a major nationwide impression. oil participant as a useful asset.

Sirius XM, the guardian firm of Sirius Satellite tv for pc Radio and Pandora, has additionally struggled as a consequence of subscriber traits. The corporate has invested closely in its podcast platform and has taken a number of company steps to make the inventory extra enticing, however there may be clearly extra work to be achieved.

VeriSign has underperformed as a consequence of regulatory issues and questions on its market and future development.

It is definitely attainable that Buffett and Berkshire are beginning to see shopping for alternatives. Securities legal guidelines solely require quick disclosure of shares wherein Berkshire owns no less than 10%. So it is attainable that Berkshire bought extra shares within the fourth quarter and even initiated new positions.

#Warren #Buffett #hit #purchase #button #million #Oracle #Omaha #beginning #inventory #market , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america