Actions of Apple (NASDAQ:AAPL) have generated returns of 33% in 2024 as of December 30. They’ve gained momentum because the firm reported outcomes for its fourth quarter of fiscal 2024 (which ended September 28) on October 31.

Many buyers turned optimistic about Apple’s prospects after seeing these outcomes, which revealed elevated gross sales of iPhones, iPads and MacBooks. Moreover, the corporate’s companies enterprise recorded double-digit year-over-year development throughout the quarter.

However what are the prospects for Apple’s principal product traces for 2025? Can this tech large preserve its latest rally and go larger subsequent 12 months?

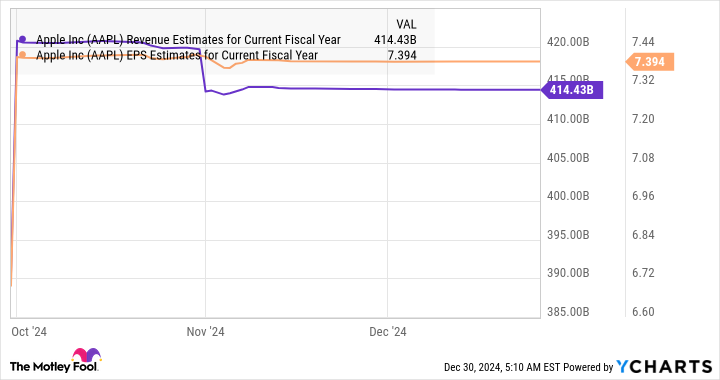

Apple’s income elevated 6% 12 months over 12 months within the fiscal fourth quarter, to $94.9 billion. Adjusted earnings rose 12% to $1.64 per share after excluding the one-time impression of the European Court docket’s state assist ruling. Together with the impression of this resolution, Apple’s diluted earnings got here to $0.97 per share, in comparison with $1.46 per share in the identical quarter final 12 months.

For the fiscal 12 months, income elevated 2% to $391 billion, however adjusted earnings declined to $6.08 per share from $6.13 per share for fiscal 2023 (together with the impression of the choice of the European Court docket). This reveals how Apple’s development accelerated in the direction of the tip of the fiscal 12 months, pushed by stronger gross sales of iPhone, MacBook and iPad.

These gross sales will doubtless profit farther from the rising adoption of generative applied sciences. artificial intelligence (AI) in 2025. The corporate started rolling out its Apple Intelligence suite of generative AI options to those merchandise in 2024, with extra options turning into accessible in 2025. It’s anticipated that the gradual rollout of Apple Intelligence finally take a leap in iPhone gross sales.

For instance, IDC expects shipments of iOS-based iPhones to extend by 3.1% in 2025, whereas shipments of Android gadgets are solely anticipated to extend by 1.7%.

Favorable situations can be anticipated for MacBooks and iPads. Certainly, gross sales of those gadgets are anticipated to extend because of AI in 2025. Gartner forecasts a 165% improve in AI PC shipments in 2025, to 114 million models. Since Apple is the fourth-largest PC OEM (authentic gear producer), it’s well-positioned to learn from long-term development within the AI-enabled PC market.

On the identical time, the pill market has additionally gained spectacular momentum, with shipments growing 20% year-over-year within the third quarter of calendar 12 months 2024 (in keeping with IDC). Apple is the main participant in tablets, with practically 32% market share. All of this places Apple in a superb place to capitalize on what Gartner predicts a 9.5% improve in system spending subsequent 12 months, pushed by clients trying to entry AI capabilities.

#Apple #inventory , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america