Carnival (NYSE:CCL)(NYSE: MARKET) The inventory has made an enormous restoration because it almost sank, and yearly since its rebound, it has gotten higher. In 2023, it achieved document turnover, and in financial year 2024 (ended November 30), revenues elevated additional and Carnival returned to profitability.

Administration and Wall Avenue are trying ahead to even higher information in 2025. Let’s examine the place Carnival could possibly be in 5 years.

Carnival has turn into an actual turnaround title. In contrast to different comparable titles, it had lots of strengths earlier than, however confronted unprecedented challenges to its enterprise. This was not a younger, untested firm, however an enormous chief in its {industry}, making the potential for a turnaround extra doubtless. This has confirmed to be the case now, as folks begin reserving his world cruises once more and he’s efficiently returning to the highest.

Carnival reported a powerful fourth quarter, capping a turbulent yr. Income rose 15% year-over-year in 2024 to a document $25 billion, and internet revenue rose to $1.9 billion, reversing its losses. Adjusted earnings before interest, taxes and depreciation (EBITDA) elevated 40% from final yr and working revenue elevated 80% to $3.6 billion.

The tempo of progress is now slowing, however demand stays robust. Fourth-quarter quantity was even larger than final yr, which was doubly spectacular as a result of it was uncommon in an election yr. Practically two-thirds of properties for 2025 are already booked, and at larger costs than final yr. Administration expects robust demand to proceed by way of 2025 and internet revenue to proceed to extend. It has already ordered new ships and modified some locations to fulfill present demand, and is planning new locations to maintain tempo with cruises.

In 5 years, Carnival is anticipated to be extremely worthwhile, with income rising at a slower however regular tempo. As this occurs, there could possibly be irregularities as demand moderates. Wall Avenue expects adjusted earnings per share (EPS) of $1.76 in 2025, up from $1.42 in 2024, and additional rising to $2.03 in 2026.

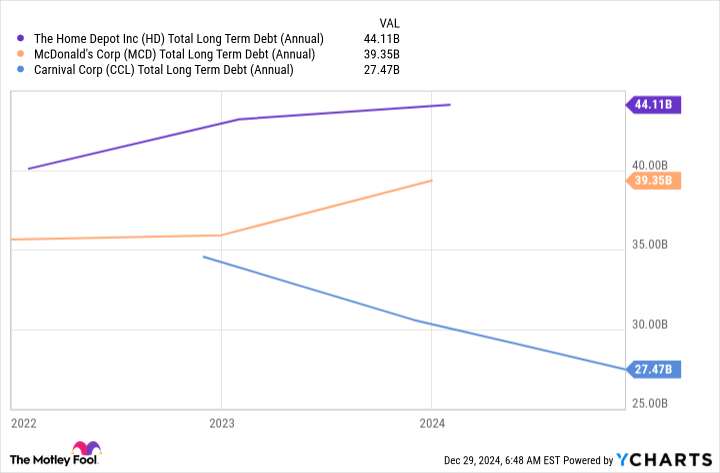

The massive threat with Carnival is that demand slows earlier than the corporate has sufficient money and a viable plan to repay its large debt. As she begins to execute on this plan and has sufficient money circulate to repay the debt at a gentle, achievable tempo, the chance decreases.

Carnival has strategically paid down its highest curiosity debt and its whole debt is already $8 billion decrease than at its peak. It has simply $4.2 billion to repay over the following two years and is producing rising free money circulate to cowl its debt whereas persevering with its progress agenda. It ended 2024 with $3.6 billion in adjusted free money circulate.

#Carnival #inventory #years , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america