Ulta Magnificence (NASDAQ:ULTA) Traders at the moment have good purpose to be disenchanted. Their inventory has been excluded from the 2024 rally, down 13% via mid-December, whereas the broader market S&P500 jumped 24%. Its plummeting valuation even attracted the eye of Warren Buffett’s workplace. Berkshire Hathawaybut the well-known investor continued sell almost all of this new position the next quarter.

It is attainable that Buffett and his investing companions have deteriorated due to the financial state of affairs of this spa and sweetness firm, which has struggled with weaker client spending traits for greater than a 12 months. Ulta inventory additionally has an opportunity to rebound if administration’s turnaround plan works.

Let’s look at which of those situations appears more than likely for 2025 and past.

Ulta nonetheless suffers from quite a few trade challenges which have hampered enterprise all through 2024.

“The headwinds haven’t abated,” CEO David Kimbell informed traders in early December when Ulta reported its third-quarter monetary outcomes. These pressures embody weaker total trade demand, in addition to elevated value cuts from opponents, who’re struggling to seize market share from more and more price-sensitive customers.

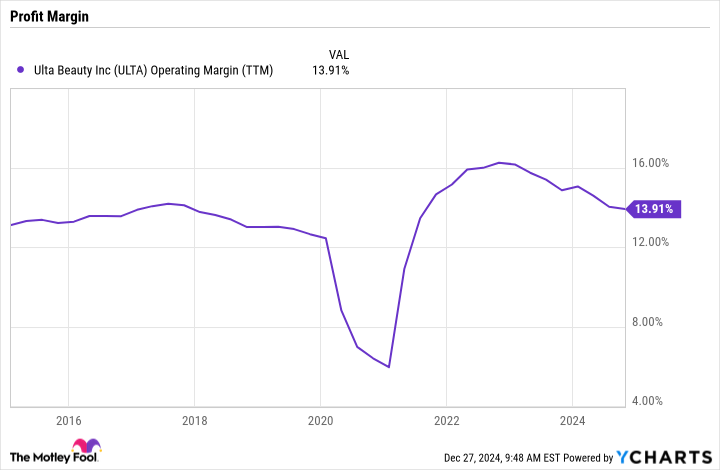

You possibly can see the outcomes of this difficult market atmosphere in Ulta’s weaker operational metrics. Identical-store gross sales (comps) are flat within the first three quarters of the 12 months, in comparison with a 7% improve within the year-ago interval, and profitability is declining. Earnings fell to $16.93 per share throughout these 39 weeks, from $17.99 per share a 12 months earlier.

Nonetheless, the most recent replace from Ulta’s management crew revealed some encouraging positives. THE retailer stays solidly worthwhile regardless of slowing progress and stock ranges are holding up effectively.

Ulta has a robust presence within the mass magnificence market, which has turn out to be extra aggressive in latest instances. Nevertheless it additionally sells many merchandise in dearer, faster-growing market segments, like luxurious skincare.

Kimbell, in its December earnings report, referred to as the “means to have interaction throughout all value factors” a aggressive benefit in sustaining buyer site visitors throughout the vacation season and past. That is why Ulta upgraded vital elements of its full-year outlook. Present forecasts now name for comps to be between a flat loss and a 1% loss, up from the earlier vary of a flat loss to a 2% decline.

The working revenue margin noticed a equally modest improve and is now anticipated to succeed in between 12.9% and 13.1% of income for the 12 months.

#Ulta #Magnificence #inventory #12 months , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america