Telecommunications firm VerizonCommunications (NYSE:VZ) is the most important wi-fi service in america, with greater than 37% of the market. The corporate can be a stellar dividend inventory with a dividend yield of 6.2% right this moment and a seamless streak of 18 consecutive annual dividend will increase.

So when you're in search of passive revenue to cowl residing bills or to reinvest and improve your portfolio combine, Verizon is a superb candidate for you proper now.

Lacking the morning scoop? Get up with Breakfast Information in your mailbox each market day. Register for free »

However what about transferring ahead? The telecommunications trade is notoriously aggressive among the many few firms that dominate the U.S. market, and there’s a fixed want to take a position to take care of and improve the huge infrastructure that makes wi-fi communications work.

Right here's what traders can anticipate from the inventory over the following 5 years.

Shoppers drive Verizon's enterprise: Client wi-fi and wireline providers (Fios fiber optic providers and landline telephone connections) account for about 75% of the corporate's whole income. Subscriber progress is crucial as a result of the trade is ruthlessly aggressive on worth; buying clients is the very best path to progress.

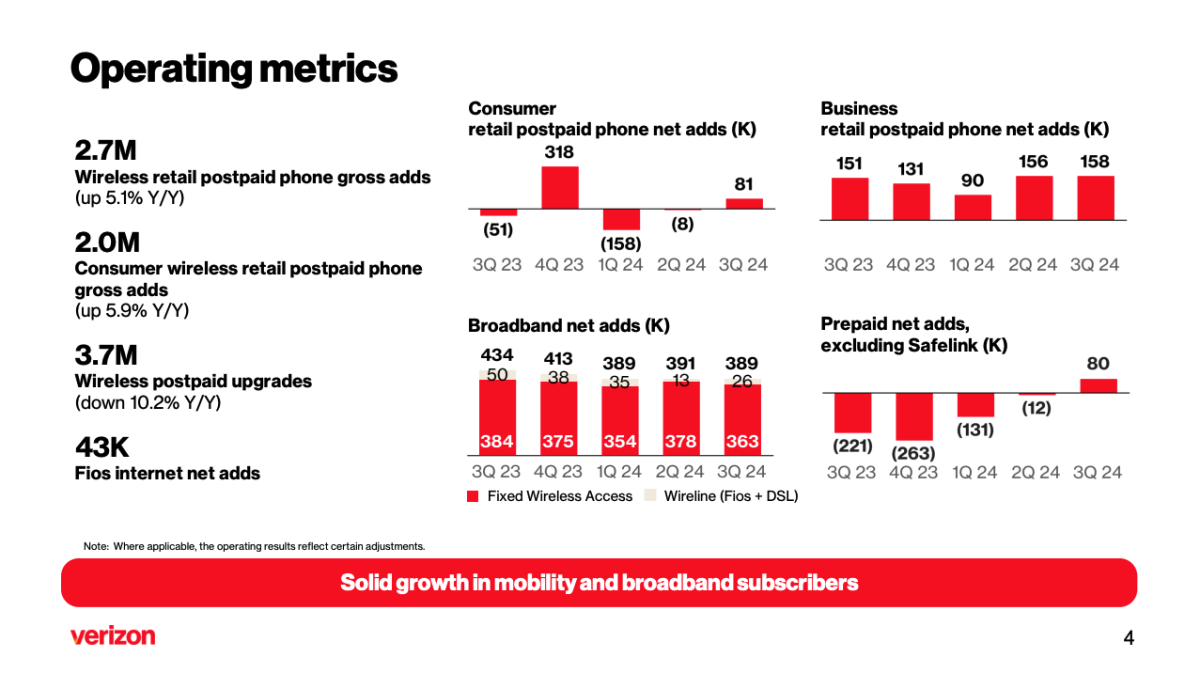

Verizon's subscriber exercise is spotty. For instance, the fourth quarter is often an essential quarter as a result of purchases shoppers are likely to make across the holidays (and the brand new iPhone sometimes launches within the fall). As you’ll be able to see, subscriber losses have been trending down because the first quarter, turning into optimistic within the final quarter:

Verizon acquired TracFone, a number one pay as you go telephone service with 20 million customers on the time, in late 2021. Nonetheless, Verizon has bled pay as you go clients since closing the acquisition. It's encouraging to see Verizon slowly stemming these losses and returning to pay as you go buyer progress within the third quarter.

Verizon has progress alternatives in fiber optics (Fios) and advanced computing. As extra units connect with networks, they should transmit extra information sooner. This extends throughout the whole financial system, from manufacturing unit tools to autonomous automobiles. Verizon is progressively increasing its Fios providers, together with fiber optic Web, permitting for a lot larger bandwidth.

The corporate has agreed to amass Border communicationsthe nation's largest fiber optic supplier, has invested $20 billion to increase its fiber optic footprint. After closing the acquisition, Verizon could have roughly 25 million fiber clients, with a goal of 30 million for 2028 and a long-term aim of between 35 and 40 million.

#Verizon #Communications #years, #gossip247.on-line , #Gossip247

,