Synthetic intelligence (AI) gives many thrilling long-term potentialities, however this know-how’s thirst for computing energy is a certainty that has fueled outstanding progress within the semiconductor sector. Chip corporations like Nvidia (NASDAQ:NVDA) And Broadcom (NASDAQ:AVGO) took off with the belief that AI creates billions of {dollars} of alternatives for everybody. Since January, each titles have exceeded the S&P500though Nvidia led the best way, up over 180%.

Each corporations predict massive issues in 2025. Nvidia is rolling out its successor to its wildly in style Hopper AI chip structure. On the identical time, Broadcom not too long ago introduced main AI chip offers which might be anticipated to drive progress over the approaching years.

However which inventory is greatest to purchase for 2025?

Nvidia is arguably the well-known title amongst AI traders. The corporate’s experience in GPU (graphics processing unit) chips has translated properly into AI. Nvidia’s Hopper accelerator chip structure has grow to be the benchmark for know-how corporations creating AI, which requires massive quantities of computing energy to coach on massive quantities of information.

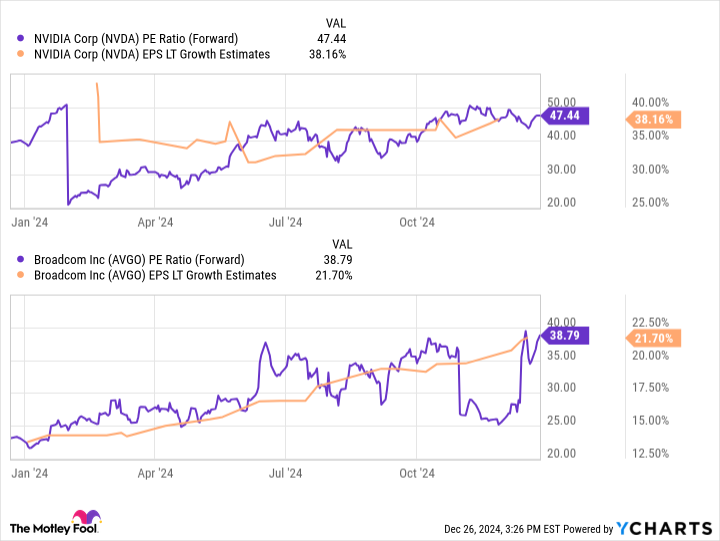

The H100 chip stays in style, however Nvidia is rolling out Blackwell chips, the next-generation structure, to fulfill the rising calls for of smarter AI fashions. Nvidia CEO Jensen Huang thinks Blackwell might be THE the corporate’s most profitable product. Analysts estimate that Nvidia will develop earnings by 38% on common over the long run, reflecting these excessive expectations.

Broadcom has an extended and profitable historical past within the semiconductor area, specializing in networking and different connectivity purposes. Nevertheless, it is not nearly fleas anymore; the corporate has diversified into enterprise infrastructure software program, which now accounts for round 41% of whole income. Broadcom can also be more and more getting concerned in AI chips. In fiscal 2024, its AI-related revenues totaled $12.2 billion, a rise of 220% from final yr.

Administration not too long ago acknowledged a number of blockbuster offers to develop AI inference chips for main AI corporations (unnamed however rumored to incorporate OpenAI and Apple) because of its XPU (Excessive Processing Unit) chips. Broadcom estimates its whole AI alternative might vary between $60 billion and $90 billion by 2027, with administration forecasting substantial market share. Analysts estimate that Broadcom’s long-term earnings progress will common almost 22% per yr.

General, each corporations have seemingly discovered alternative to thrive in AI.

On condition that each corporations seem well-positioned for progress, the perfect purchase might come all the way down to which one gives the perfect worth. The PEG ratio is great for this. It compares a inventory’s valuation to the corporate’s anticipated progress. The decrease the ratio, the higher deal you get.

#chip #inventory #purchase #Nvidia #Broadcom , #Gossip247

,

rupert murdoch

crypto information

oracle inventory

goog inventory

googl inventory

mondelez

wreaths throughout america