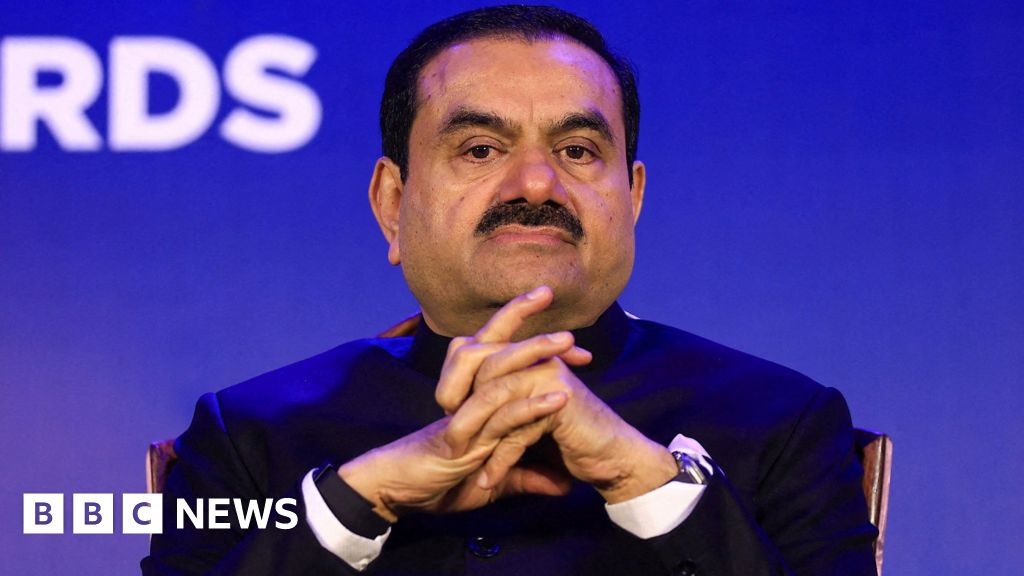

Reuters

ReutersCorruption expenses introduced by a US court docket towards the Adani Group are unlikely to considerably upend India's clear power targets, business executives informed the BBC.

Delhi has dedicated to assembly half of its power wants, or 500 gigawatts (GW) of electrical energy, from renewable sources by 2032, which is vital to international efforts to fight local weather change.

The Adani group is anticipated to contribute one-tenth of this capability.

THE legal problems in the United States may briefly delay the group's enlargement plans however won’t have an effect on the federal government's total targets, analysts say.

India has made spectacular progress in constructing clear power infrastructure over the previous decade.

The nation is rising “the quickest amongst main economies” in growing renewable power capability, in line with the Worldwide Power Company.

Put in clear power capability has elevated fivefold, with round 45% of the nation's electrical energy era capability – of just about 200 GW – coming from non-fossil gas sources.

Accusations towards Adani Group – essential to India's clear power ambitions – are 'like a passing darkish cloud' and won’t have a major impression on that momentum, a former CEO says from a rival firm, wishing to stay nameless.

Getty Photographs

Getty PhotographsGautam Adani pledged to speculate $100bn (£78.3bn) in India's power transition. Its inexperienced power arm is the nation's largest renewable power firm, producing almost 11 GW of fresh power by a various portfolio of wind and photo voltaic tasks.

Adani goals to extend this capability to 50 GW by 2030, which can signify nearly 10% of the nation's put in capability.

Greater than half, or 30 GW, shall be produced in Khavda, within the western Indian state of Gujarat. It’s the world's largest clear power plant, stated to be 5 instances the scale of Paris and the centerpiece of Adani's renewable power crown.

However Khavda and Adani's different renewable power services at the moment are on the middle of expenses introduced by U.S. prosecutors: They allege the corporate gained contracts to produce electrical energy to state distribution firms from these services, in change for bribes to Indian officers. The group denied this.

However the penalties on the enterprise stage are already seen.

When the indictment was made public, Adani Inexperienced Power instantly canceled a $600 million bond providing in the USA.

French group TotalEnergies, which owns 20% of Adani Inexperienced Power and has a three way partnership to develop a number of renewable power tasks with the conglomerate, introduced it could halt any additional capital injections into the corporate.

Main credit standing businesses – Moody's, Fitch and S&P – have since modified their outlook on Adani group firms, together with Adani Inexperienced Power, to unfavourable. It will impression the corporate's potential to entry funds and make elevating capital costlier.

Analysts have additionally raised considerations about Adani Inexperienced Power's potential to refinance its debt, as worldwide lenders develop weary of including publicity to the group.

International lenders like Jeffries and Barclays are already reportedly reviewing their ties with Adani, even because the group's reliance on international banks and worldwide and native bond points for long-term debt has elevated from to barely 14% in fiscal 2016 to nearly 60%. of date, in line with a notice by Bernstein.

Japanese brokerage agency Nomura says new funding could dry up within the quick time period however is anticipated to “progressively resume in the long run”. In the meantime, Japanese banks like MUFG, SMBC, Mizuho are anticipated to proceed their relationships with the group.

“The reputational and mawkish impression” will fade in just a few months as Adani builds “robust, strategic belongings and creates long-term worth,” the unnamed CEO stated.

Getty Photographs

Getty PhotographsAn Adani Group spokesperson informed the BBC it was “dedicated to assembly its 2030 targets and assured of delivering 50GW of renewable power capability”.

Adani shares have recovered sharply from the lows they reached after the US court docket indictment.

Some analysts informed the BBC {that a} doable slowdown in Adani's funding may really find yourself benefiting its opponents.

Whereas Adani's monetary affect has allowed it to develop quickly within the sector, its opponents resembling Tata Energy, ReNew Energy, backed by Goldman Sachs, Greenko and state-owned NTPC Ltd are additionally considerably growing their manufacturing and manufacturing capability.

“Adani shouldn’t be a champion of inexperienced power. It’s a main participant that has walked each side of the road, being the biggest personal developer of coal vegetation on this planet,” stated Tim Buckley, director from Local weather Power Finance.

A big entity, “perceived as corrupt” and more likely to gradual its enlargement, may imply “extra money will begin flowing to different inexperienced power firms,” he stated.

In response to Vibhuti Garg, director of South Asia on the Institute of Power Economics and Monetary Evaluation (IEEFA), market fundamentals additionally stay robust, with demand for renewable power outstripping provide in India, which ought to maintain the urge for food for large investments intact.

What may really gradual the tempo of India's clear power ambitions is its personal paperwork.

“The businesses we observe are very optimistic. Financing shouldn’t be a problem for them. Moderately, it’s state-level laws which can be a deterrent,” says Garg.

Getty Photographs

Getty PhotographsMost state-owned electrical energy distribution firms proceed to face monetary constraints, choosing cheaper fossil fuels, whereas dragging their ft in signing buy agreements.

In response to ReutersThe controversial tender gained by Adani was the primary main contract awarded by state-owned Photo voltaic Power Corp of India (SECI) and not using a assured buy settlement from distributors.

The SECI chairman informed Reuters there have been 30 GW of operational inexperienced power tasks out there with out consumers.

Consultants say the 8GW photo voltaic contract on the coronary heart of Adani's US indictment additionally sheds gentle on the difficult bidding course of, which required solar energy firms to additionally manufacture modules, which restricted the variety of bidders and led to larger power prices.

The court docket's indictment will definitely result in a “tightening of the principles on tenders and tenders”, believes Ms Garg.

A cleaner tender course of, decreasing threat for each builders and traders, shall be necessary sooner or later, Mr Buckley agrees.

Comply with BBC Information India on Instagram, YouTube, Twitter And Facebook.

#corruption #accusations #hamper #India39s #renewable #power #targets, #gossip247.on-line , #Gossip247

,

—

earthquake california

earthquake

north korea

cowboys vs bengals

heisman finalists

altoona mcdonalds pa

taylor college

korn avenged sevenfold

tee higgins

nancy mace

cyberpunk 2077 replace 2.2

greg gutfeld

ftc vs epic video games

taylor lorenz

chris evans

ryan murphy

usgs

karl anthony cities

kyle tucker

jake ferguson

blackhawks vs rangers

scottie barnes

knicks vs raptors

orcl inventory

rj barrett

ja’marr chase

miley cyrus

jordan peterson

pink wings vs sabres

alec baldwin

jeremy allen white

kcra

bo bassett

steven nelson

heisman

avengers doomsday

justin baldoni

minnesota basketball

chuck scarborough

kari lake

vcu basketball

ron howard

jakob poeltl

it ends with us netflix

josh shapiro

reno information

jalen tolbert